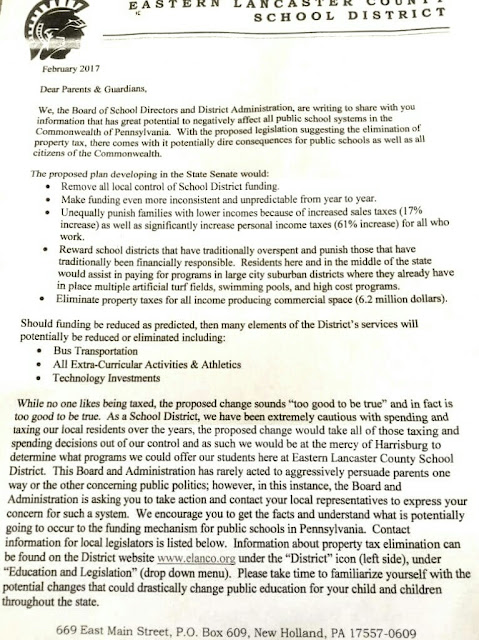

The letter shown above was submitted to Columbia Spy today and is purportedly from Elanco’s “Board of School Directors and District Administration.” The letter takes a stand against property tax elimination and lays out reasons why legislation supporting it should not be passed.

Been waiting years for this reform to happen. It's time everyone takes a turn in school education taxes. Just because I own a home I am assumed to be well off. I simply have the American dream to own a place I call mine. And to pull the lower income card. Really. The letter writers have no clue about homeowner's trials & tribulations. My mom deserves to live the rest of her life in the home my dad & her labored for. Not give it up because of the high taxed here. I say bring on the change.

LikeLike

They want to protect their own interests. On the incomes they make, taxes aren't a problem. After a letter like this I hope Columbia has sense to tell ELANCO to hit the road.

LikeLike

The letter is a SCARE tactic.

LikeLike

Tell the school board directors of ELANCO to live on the income of the average Columbian. I am sure they would tear that letter up in an instance.

LikeLike

This letter is outrageous! Absolutely agree, this is a scare tactic aimed at making parents afraid of losing bus transportation and athletic programs. How about keeping those things and instead shave off some of the administration positions.

LikeLike

I better NOT receive a letter like this or the school board and EVERYONE else will hear about it.

LikeLike

I would suggest that readers take time to research the pro's and con's of the proposed Tax Independence bills in Harrisburg. (HB 76 and SB 76) If passed, the biggest winners will be retired homeowners. The biggest losers will be working homeowners. The proposed bills still allow school districts to tax properties for the purpose of debt reduction and that tax could last for up to 20 years as most debt is issued in 20 year bonds. That means you would still be paying a part of your current property tax PLUS all the new income and sale taxes included in the new bill. Just something to think about!

LikeLike

No one loves to pay taxes, but if they increase the sale tax 1 percent and the wage tax,at least more people would be contributing to the tax fund. There is no perfect solution to the tax problem, but something got to be done.

LikeLike

The biggest losers will be renters, who currently pay the least amount of school tax. And why should retired people who live on a small and limited income be at risk for losing their home? Stop the LIES and propogation of fear that the working middle class will be hit the hardest. We already are, it can only get better. Yes homeowners would continue to pay towards paying down the debt until it's gone. That would be 10% a year.Those of you who want to take the time to educate yourself on this should research the bill for the truth.Just something to think about!

LikeLike

The important thing here is that those who have disposable income and are spenders, will be contributing more to the school tax.

LikeLike

Find the facts for yourself here:www.ptcc.us

LikeLike

I am a retired working homeowner. Working only to pay taxes so I don't lose my home. Where do I fit into your equation?

LikeLike

It's time to spread the burden out. No one should have to pay property tax after age 65. Surely their own kids are out of school and they've been paying taxes for decades. Sales tax will be a choice, if you want the item you pay it. Unlike the property tax bill, it's going to hit the wallet in smaller amounts. That will make it manageable for more people.

LikeLike

So, anonymous, you've been drinking the Kool-Aid. Too bad you feel that you have to make everyone else taste it as well.Yes, a small amount of property tax will remain to service existing debt but the time can vary between one year and twenty years depending on the term of the debt. You could have said that but it wouldn't have been nearly as alarming. And the Independent Fiscal Office said that the average remaining debt payment statewide will be about 18% of the homeowners' current property tax payment. Yes, it is something to think about when you have all the facts.Your class warfare tactics of pitting retired versus working homeowners is as sleazy as it gets. The PA Independent Fiscal Office analysis of the legislation said this:• The analysis indicates that HB 76 will cause home values to increase, on average, by more than 10% statewide. (Page 23) (This will restore a large amount of the equity that was lost to homeowners during the 2008 housing downturn.)• Working age homeowners realize a tax cut. The analysis finds that the increase in federal income tax (through lower itemized deductions), state income tax, and sales tax is more than offset by the reduction in property taxes. (Page 21)• Retired homeowners realize a significant reduction in taxes. The analysis finds that the property tax reduction easily offsets any increase from the higher sales tax. (Page 21)For whom are you a shill?The details of this grassroots-crafted legislation are at http://www.ptcc.us. Learn the truth!

LikeLike

Thank you Mr. Harkness.

LikeLike

And you can learn the truth by researching, for yourself, other pros and cons of this type of legislation other than reading the rhetoric on a biased website. Not sure what report you were reading Mr. Harkness, but the report issued by the independent financial office in 2013 clearly stated the state would run a one billion dollar deficit within the first two years if the legislation, as written, would have been enacted at that time. (See IFO special report 2013-7…don't you hate it when someone actually reads the information instead of relying on the rhetoric of one website!) Currently, there is no House Bill 76 or Senate Bill 76, in the new legislative session, as referenced in these comments. Under the old, expired bills, of the last session, there was nothing written in the bills that would limit a school district on the amount of property tax they could levy for debt burden which could be a huge hit on working property owners. Hey, I am all for eliminating the property tax but it has to be done right. The prior bills, SB 76 and HB 76, were horrible. Bottom line, if any type of property tax elimination is to be considered, it MUST be coupled with regulations that restrict the ridiculous spending our school boards seem to love. Without these restrictions, school boards will spend more during good financial times. School unions will demand more pay and benefits during good financial times. When a recession comes along, and the sales and income tax revenue drops, what do we do? How do we continue to fund the spending the school boards committed to when times were good. Our state legislature needs to fine tune the old bills and introduce new bills that eliminate or cap the amount a property owner must pay for debt burden!Our state legislature require school boards to restrict the amount of spending, including teachers and administrators salaries, to an amount that could be absorbed when revenue from the income tax and sales tax is down.Done right, property tax elimination is a win-win for all. Done wrong, it is a recipe for disaster.

LikeLike

No, what I hate is a pompous person that signs anonymous. If all your claims are correct back them up with your name please. It's only biased when you don't agree.

LikeLike

I am a widow and lost my job last year. I'm 59 to old to get a new job and too young to collect SS. I can't afford to pay my school taxes this year and stand to lose everything my husband and I worked for. I don't think it is fair to lose my home because of a school tax! I paid my fair share of school taxes and have not had kids in school for over 20 years. I do not benefit from this school tax. They will take me out in a body bag before they take my home from me. ELANCO shove your taxes, curb your spending or just close down.

LikeLike

Been waiting years for this reform to happen. It's time everyone takes a turn in school education taxes. Just because I own a home I am assumed to be well off. I simply have the American dream to own a place I call mine. And to pull the lower income card. Really. The letter writers have no clue about homeowner's trials & tribulations. My mom deserves to live the rest of her life in the home my dad & her labored for. Not give it up because of the high taxed here. I say bring on the change.

LikeLike

They want to protect their own interests. On the incomes they make, taxes aren't a problem. After a letter like this I hope Columbia has sense to tell ELANCO to hit the road.

LikeLike

The letter is a SCARE tactic.

LikeLike

Tell the school board directors of ELANCO to live on the income of the average Columbian. I am sure they would tear that letter up in an instance.

LikeLike

This letter is outrageous! Absolutely agree, this is a scare tactic aimed at making parents afraid of losing bus transportation and athletic programs. How about keeping those things and instead shave off some of the administration positions.

LikeLike

I better NOT receive a letter like this or the school board and EVERYONE else will hear about it.

LikeLike

I would suggest that readers take time to research the pro's and con's of the proposed Tax Independence bills in Harrisburg. (HB 76 and SB 76) If passed, the biggest winners will be retired homeowners. The biggest losers will be working homeowners. The proposed bills still allow school districts to tax properties for the purpose of debt reduction and that tax could last for up to 20 years as most debt is issued in 20 year bonds. That means you would still be paying a part of your current property tax PLUS all the new income and sale taxes included in the new bill. Just something to think about!

LikeLike

No one loves to pay taxes, but if they increase the sale tax 1 percent and the wage tax,at least more people would be contributing to the tax fund. There is no perfect solution to the tax problem, but something got to be done.

LikeLike

The biggest losers will be renters, who currently pay the least amount of school tax. And why should retired people who live on a small and limited income be at risk for losing their home? Stop the LIES and propogation of fear that the working middle class will be hit the hardest. We already are, it can only get better. Yes homeowners would continue to pay towards paying down the debt until it's gone. That would be 10% a year.Those of you who want to take the time to educate yourself on this should research the bill for the truth.Just something to think about!

LikeLike

The important thing here is that those who have disposable income and are spenders, will be contributing more to the school tax.

LikeLike

Find the facts for yourself here:www.ptcc.us

LikeLike

I am a retired working homeowner. Working only to pay taxes so I don't lose my home. Where do I fit into your equation?

LikeLike

It's time to spread the burden out. No one should have to pay property tax after age 65. Surely their own kids are out of school and they've been paying taxes for decades. Sales tax will be a choice, if you want the item you pay it. Unlike the property tax bill, it's going to hit the wallet in smaller amounts. That will make it manageable for more people.

LikeLike

So, anonymous, you've been drinking the Kool-Aid. Too bad you feel that you have to make everyone else taste it as well.Yes, a small amount of property tax will remain to service existing debt but the time can vary between one year and twenty years depending on the term of the debt. You could have said that but it wouldn't have been nearly as alarming. And the Independent Fiscal Office said that the average remaining debt payment statewide will be about 18% of the homeowners' current property tax payment. Yes, it is something to think about when you have all the facts.Your class warfare tactics of pitting retired versus working homeowners is as sleazy as it gets. The PA Independent Fiscal Office analysis of the legislation said this:• The analysis indicates that HB 76 will cause home values to increase, on average, by more than 10% statewide. (Page 23) (This will restore a large amount of the equity that was lost to homeowners during the 2008 housing downturn.)• Working age homeowners realize a tax cut. The analysis finds that the increase in federal income tax (through lower itemized deductions), state income tax, and sales tax is more than offset by the reduction in property taxes. (Page 21)• Retired homeowners realize a significant reduction in taxes. The analysis finds that the property tax reduction easily offsets any increase from the higher sales tax. (Page 21)For whom are you a shill?The details of this grassroots-crafted legislation are at http://www.ptcc.us. Learn the truth!

LikeLike

Thank you Mr. Harkness.

LikeLike

And you can learn the truth by researching, for yourself, other pros and cons of this type of legislation other than reading the rhetoric on a biased website. Not sure what report you were reading Mr. Harkness, but the report issued by the independent financial office in 2013 clearly stated the state would run a one billion dollar deficit within the first two years if the legislation, as written, would have been enacted at that time. (See IFO special report 2013-7…don't you hate it when someone actually reads the information instead of relying on the rhetoric of one website!) Currently, there is no House Bill 76 or Senate Bill 76, in the new legislative session, as referenced in these comments. Under the old, expired bills, of the last session, there was nothing written in the bills that would limit a school district on the amount of property tax they could levy for debt burden which could be a huge hit on working property owners. Hey, I am all for eliminating the property tax but it has to be done right. The prior bills, SB 76 and HB 76, were horrible. Bottom line, if any type of property tax elimination is to be considered, it MUST be coupled with regulations that restrict the ridiculous spending our school boards seem to love. Without these restrictions, school boards will spend more during good financial times. School unions will demand more pay and benefits during good financial times. When a recession comes along, and the sales and income tax revenue drops, what do we do? How do we continue to fund the spending the school boards committed to when times were good. Our state legislature needs to fine tune the old bills and introduce new bills that eliminate or cap the amount a property owner must pay for debt burden!Our state legislature require school boards to restrict the amount of spending, including teachers and administrators salaries, to an amount that could be absorbed when revenue from the income tax and sales tax is down.Done right, property tax elimination is a win-win for all. Done wrong, it is a recipe for disaster.

LikeLike

No, what I hate is a pompous person that signs anonymous. If all your claims are correct back them up with your name please. It's only biased when you don't agree.

LikeLike

I am a widow and lost my job last year. I'm 59 to old to get a new job and too young to collect SS. I can't afford to pay my school taxes this year and stand to lose everything my husband and I worked for. I don't think it is fair to lose my home because of a school tax! I paid my fair share of school taxes and have not had kids in school for over 20 years. I do not benefit from this school tax. They will take me out in a body bag before they take my home from me. ELANCO shove your taxes, curb your spending or just close down.

LikeLike